Saudi Arabia Online Grocery Market Trends: Digital Adoption, Consumer Shift, and Retail Transformation

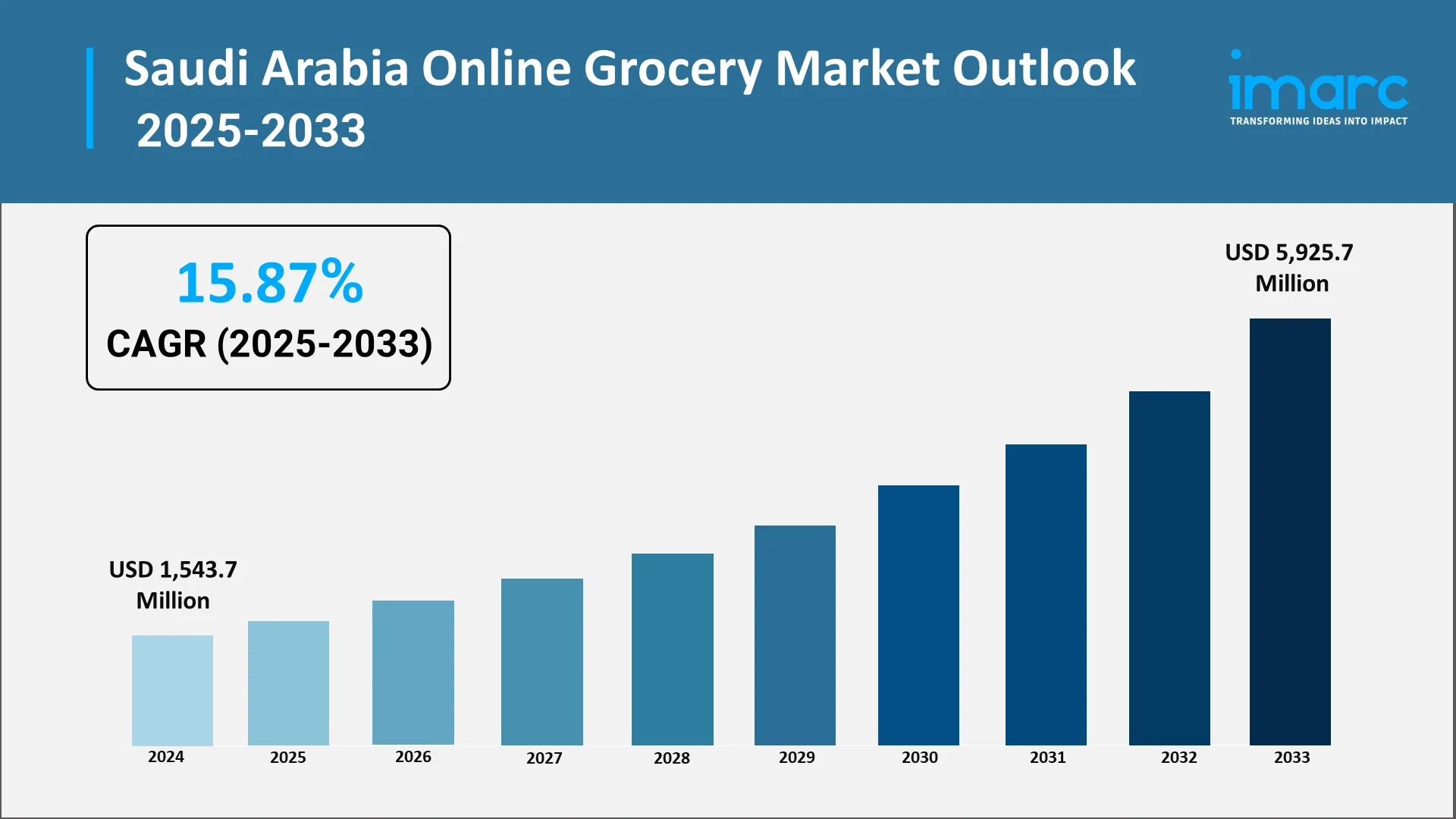

The Saudi Arabia online grocery market is experiencing transformative growth, driven by widespread digital adoption, evolving consumer preferences, and strategic government initiatives aligned with Vision 2030. As one of the fastest-growing e-commerce segments in the Middle East, the online grocery sector is reshaping how Saudi consumers shop for everyday essentials. The market's expansion is fueled by increasing smartphone penetration, improved logistics infrastructure, and a demographic shift toward younger, tech-savvy consumers who prioritize convenience and speed. According to IMARC Group, the market reached USD 1,543.7 Million in 2024.

Explore in-depth findings for this market, Request Sample

Online grocery platforms have emerged as critical players in modernizing Saudi Arabia's retail landscape, offering consumers unprecedented access to fresh produce, pantry staples, and specialty products through intuitive mobile applications and websites. The surge in demand for rapid delivery services, contactless payment options, and personalized shopping experiences has accelerated the digital transformation of traditional supermarket chains and attracted significant investment from both local and international players. This convergence of technology, consumer behavior, and retail innovation positions Saudi Arabia's online grocery market for sustained growth throughout the coming decade.

How Vision 2030 is Transforming Saudi Arabia's Online Grocery Industry:

Vision 2030 serves as a powerful catalyst for the online grocery sector's evolution in Saudi Arabia, fundamentally reshaping the retail ecosystem through strategic digitalization initiatives and infrastructure development. The ambitious national transformation program has accelerated e-commerce adoption by targeting a 70% non-cash transaction rate by 2025, a milestone that was reached in 2023 itself, demonstrating the Kingdom's exceptional progress toward becoming a cashless society. This achievement has directly supported the growth of digital grocery platforms that depend on seamless payment solutions.

Government-led efforts to diversify the economy beyond oil have created favorable conditions for retail innovation, including the introduction of advanced payment technologies such as the Mada national payment network and the SADAD system, which have streamlined e-payment processes across sectors and reduced friction in online transactions. The dramatic growth in digital payments is evident in recent data showing that MADA card e-commerce sales surged, reflecting strong consumer confidence in digital payment methods. Furthermore, only 22% of consumer transactions are still in cash according to VISA Middle East, marking a significant shift from the Kingdom's traditionally cash-based economy.

The expansion of digital payment infrastructure continues with Google Pay set to launch in Saudi Arabia through the MADA payment system in 2025, further enhancing payment options for online grocery shoppers. Market projections as per Amazon Payment Services indicate that digital wallet usage in Saudi Arabia is expected to rise from 24% to 36% for online retail and from 22% to 37% in POS transactions, fueled by MADA's 93% market share in card payments.

Furthermore, Vision 2030's emphasis on improving quality of life and promoting healthier lifestyles has aligned perfectly with the online grocery delivery Saudi Arabia to offer fresh, organic, and health-focused product selections while reducing the time constraints associated with traditional shopping. Government incentives and collaborations with fintech firms have driven the widespread adoption of digital wallets and mobile payment solutions, creating a robust foundation for e-commerce growth. These strategic initiatives have not only legitimized online grocery shopping as a mainstream retail channel but have also positioned Saudi Arabia as a regional leader in digital commerce, attracting substantial foreign investment from global players entering the market and fostering local innovation that continues to drive expansion across all consumer segments.

Key Industry Trends:

Rapid Expansion of Quick-Commerce and 30-Minute Delivery Services

The quick-commerce revolution is reshaping Saudi e-grocery trends, with ultra-fast delivery services becoming a key competitive advantage. Major platforms are using micro-fulfillment centers and dark stores in high-density areas to ensure delivery within 15-30 minutes. This model meets the demand for immediacy, particularly among younger consumers who prioritize time efficiency and spontaneous buying decisions.

The infrastructure behind quick-commerce includes advanced inventory systems, real-time demand forecasting, and optimized routing algorithms to reduce delivery times while maintaining quality. Companies are expanding dark stores in Riyadh, Jeddah, and Dammam, recognizing that proximity to customers is crucial for fast delivery.

This has heightened competition, with service quality and delivery speed becoming key differentiators. The trend has also influenced product assortments, focusing on high-frequency and impulse-buy items. As the market matures, operators are refining efficiency and exploring innovations like autonomous vehicles and drones for future scalability.

Growing Adoption of Mobile Apps and Digital Payment Solutions

Mobile-first strategies are crucial in Saudi Arabia’s online grocery market, driven by high smartphone penetration and consumer preference for app-based shopping. Leading platforms have heavily invested in feature-rich mobile apps with intuitive navigation, personalized recommendations, voice search, and augmented reality for product visualization. These enhancements simplify the shopping process, attracting a broad range of consumers.

The growth of digital payment solutions has also built consumer trust, with widespread adoption of digital wallets, contactless payments, and integrated banking apps overcoming barriers like cash-on-delivery preferences and payment security concerns. Government initiatives supporting cashless transactions and robust cybersecurity have accelerated this shift.

Mobile apps now offer seamless integration for one-click purchasing and subscription management. AI and machine learning improve personalization, remembering purchase histories and optimizing recommendations. Push notifications, loyalty programs, and gamification boost engagement. The combination of advanced mobile technology and secure payments has made mobile apps the main interface for grocery shopping, driving widespread adoption.

Rise of Omni-Channel Retail Strategies by Supermarket Chains

Traditional supermarket chains in Saudi Arabia are transforming into omni-channel retailers, blending online and offline experiences to stay competitive. By unifying inventory management, customer data, and fulfillment operations across physical stores and digital platforms, they enable customers to transition seamlessly between shopping methods, such as browsing online, using click-and-collect, or opting for home delivery.

This omni-channel approach allows retailers to use their physical stores as fulfillment centers, reducing the need for standalone dark stores. Technologies like in-store navigation apps, shelf-scanning tools, and unified commerce platforms improve efficiency.

Forward-thinking chains are also using their physical presence for unique experiences, like fresh food counters and personalized consultations, which online-only retailers can't match. Integrating loyalty programs across channels gives retailers valuable customer insights to refine merchandising, promotions, and marketing strategies. This approach strengthens customer loyalty and provides a competitive edge over pure-play online platforms, positioning omni-channel retailers for long-term success.

Increasing Popularity of Subscription-Based and Auto-Replenishment Models

Subscription services and auto-replenishment programs are gaining popularity in Saudi Arabia's online grocery market, offering convenience for consumers and predictable revenue for platforms. Customers can set up recurring deliveries for commonly purchased items like dairy, beverages, and household essentials, ensuring continuous product availability without the need for repeated ordering. Subscription tiers often include perks like free delivery, exclusive discounts, and early access to promotions.

These models appeal to busy professionals and families seeking time savings and financial predictability. Platforms use algorithms to analyze purchase patterns and suggest subscription options, with flexible terms allowing customers to pause, modify, or cancel subscriptions.

Auto-replenishment technology, powered by predictive analytics and machine learning, anticipates product shortages and schedules deliveries proactively, preventing stockouts. This enhances customer satisfaction by reducing the mental load of managing inventory. Platforms are also exploring exclusive subscription offerings and customized bundles, further adding value and strengthening brand partnerships.

Growth of Online Fresh Food & Organic Product Categories

The demand for fresh food and organic products has surged in Saudi Arabia, driven by health-conscious consumption and quality-focused purchasing. Online grocery platforms have invested heavily in sourcing, handling, and delivering perishable items like produce, dairy, meat, and seafood, addressing concerns about product quality. Cold chain logistics, temperature-controlled packaging, and quick delivery ensure freshness that meets or exceeds traditional retail standards.

The organic and health-focused segment is growing rapidly, aligning with Vision 2030’s wellness goals and rising awareness of nutrition and sustainability. Platforms are expanding organic offerings, partnering with local farms and international suppliers to provide certified organic produce, dietary products, and functional foods.

This growth is supported by younger consumers who prefer organic and sustainable foods, as well as expatriates seeking familiar international brands. Platforms differentiate through curated selections, stringent quality control, and satisfaction guarantees, proving that online grocery platforms can successfully offer fresh food beyond shelf-stable items.

Investment in Cold Chain Networks for Faster and Safer Deliveries

The development of sophisticated cold chain infrastructure represents a critical enabler of Saudi Arabia's online grocery market expansion, particularly for perishable and temperature-sensitive products. Major platforms and logistics providers are investing heavily in refrigerated warehousing facilities, temperature-controlled delivery vehicles, and advanced monitoring systems that maintain optimal conditions throughout the supply chain. These investments address fundamental challenges associated with Saudi Arabia's climate, where extreme temperatures pose significant risks to product quality and food safety.

Modern cold chain networks incorporate IoT sensors and real-time monitoring technologies that track temperature, humidity, and location data throughout the fulfillment and delivery process. This technological integration enables immediate intervention if conditions deviate from specified parameters, ensuring product integrity and reducing waste. Automated cold storage facilities with zone-specific temperature controls accommodate diverse product requirements, from frozen foods to fresh produce, while optimizing energy efficiency and operational costs.

The strategic expansion of cold chain infrastructure is extending beyond major urban centers into secondary cities and suburban areas, democratizing access to fresh and frozen products for consumers across different regions. This geographic expansion is supported by partnerships between online platforms, logistics specialists, and refrigeration technology providers who recognize the market's growth potential. Enhanced cold chain capabilities also facilitate the introduction of new product categories such as meal kits, prepared foods, and international specialty items that require precise temperature management. As these networks mature, they create competitive advantages for operators who can guarantee superior product quality and extend delivery ranges while maintaining freshness standards.

Market Segmentation & Regional Insights:

The Saudi Arabia online grocery market exhibits distinct segmentation patterns across product type, business model, platform, and purchase type that shape competitive dynamics and growth opportunities. Understanding these nuanced segmentation characteristics enables stakeholders to develop targeted strategies and allocate resources effectively.

- Product Type: The market encompasses diverse product categories including vegetables and fruits, dairy products, staples and cooking essentials, snacks, meat and seafood, and others. Vegetables and fruits lead, driven by growing demand for fresh, organic produce, seasonal and exotic fruit sourcing, and competitive pricing. Dairy remains essential, with consistent demand for milk, cheese, and yogurt, bolstered by discounts and subscription models. Staples are frequently purchased, while snacks are a rising impulse-buy segment, fueled by promotions and social media marketing. The meat and seafood category benefits from improved cold chain infrastructure, addressing quality concerns and enabling online platforms to compete with traditional markets.

- Business Model: The market features pure marketplace, hybrid marketplace, and other operational models that define competitive positioning. Pure marketplace platforms connect buyers directly with sellers through digital interfaces, allowing vendors to list products while the platform facilitates transactions, benefiting from lower operational costs and scalability that make this approach attractive for startups and small businesses. Hybrid marketplace models combine elements of direct selling and third-party vendor services, with companies maintaining their own inventory while allowing external vendors to sell on their platforms, ensuring product availability and quality control. This approach is gaining traction among larger retailers seeking to enhance customer satisfaction and expand offerings beyond their direct inventory capabilities. Other models include specialized approaches such as subscription-only platforms or discount-focused retailers entering the market to serve specific consumer segments.

- Platform Distribution: The market divides between web-based and app-based platforms that cater to different user preferences and behaviors. Web-based platforms serve users accessing grocery services through websites via desktops or mobile browsers, appealing to older demographics and individuals seeking detailed product views, benefiting from user-friendly interfaces and compatibility with larger screens. App-based platforms are driving substantial market growth due to their convenience, push notifications, and personalized experiences, proving particularly popular among younger consumers and urban users owing to smartphone proliferation and mobile payment solutions that offer seamless and faster shopping experiences. The dominance of app-based platforms reflects broader digital consumption patterns, with the majority of Saudi users accessing the internet via mobile devices throughout the day.

- Purchase Type: The market segments into one-time purchases and subscription services that address different consumer needs and shopping behaviors. One-time purchases cater to customers preferring flexibility, allowing them to shop as needed without commitment, remaining the dominant choice for occasional shoppers or those purchasing specific items and contributing significantly to market revenue through promotions and discounts offered during peak seasons that attract price-conscious consumers. Subscription services are gaining traction due to their convenience, offering regular deliveries of essential groceries that appeal to busy households and working professionals, providing cost-saving benefits and consistency in supply that aligns with growing preferences for time-efficient solutions. The subscription model also enhances customer retention and provides platforms with predictable revenue streams that support long-term planning and investment.

- Regional Insights: The market exhibits significant geographic variation across the Northern and Central Region, Western Region, Eastern Region, and Southern Region, each with distinct characteristics and growth drivers. The Northern and Central Region, including Riyadh, drives a significant portion of the market due to its dense population, high internet penetration, and tech-savvy consumers. Riyadh is a digital commerce hub, attracting new platform launches and infrastructure investments. The Western Region, including Jeddah and Mecca, contributes notably with its affluent population, urban infrastructure, and growing e-commerce adoption, driven by tourism and pilgrims. The Eastern Region, with cities like Dammam, benefits from high disposable incomes and strong expatriate communities, promoting online shopping. The Southern Region, though smaller, presents emerging opportunities as infrastructure and internet connectivity improve, expanding platform reach into underserved areas.

Forecast (2025–2033):

The Saudi Arabia online grocery market is positioned for robust expansion through 2033, supported by powerful structural drivers including accelerating urbanization, continued smartphone penetration growth, and deeply embedded preferences for convenience-oriented shopping solutions. As per IMARC Group’s Saudi Arabia online grocery market research report, the industry is projected to reach USD 5,925.7 Million by 2033 at a CAGR of 15.87% from 2025-2033.

Urbanization trends will continue concentrating populations in major metropolitan areas where online grocery infrastructure is most developed, creating economies of scale that improve service quality while reducing operational costs. The ongoing expansion of urban centers and development of new residential communities aligned with Vision 2030 will provide platforms with expanding addressable markets and opportunities to establish early-mover advantages in emerging neighborhoods.

Smartphone penetration, already among the highest globally, will continue increasing alongside improvements in mobile network quality and 5G deployment, enabling richer application experiences and supporting innovative features such as live shopping, video-based product demonstrations, and augmented reality integration. These technological enhancements will reduce remaining barriers to online grocery adoption and create new engagement opportunities that drive higher transaction frequencies.

Demand drivers extending throughout the forecast period include persistently busy lifestyles among working professionals and dual-income households who prioritize time savings and convenience over traditional shopping experiences. The expansion of online delivery networks into previously underserved areas will unlock new customer segments, while competitive pricing strategies supported by improved operational efficiencies will make online grocery increasingly cost-competitive with traditional retail formats.

Rising health consciousness and wellness-focused consumption patterns will continue driving demand for organic products, specialty dietary items, and fresh food categories available through online channels. Retail digitalization will progress beyond initial e-commerce capabilities toward comprehensive omni-channel ecosystems that seamlessly integrate online and offline touchpoints, creating unified customer experiences that strengthen loyalty and increase wallet share.

Investment trends suggest continued capital flows into logistics infrastructure, technology platforms, and market expansion initiatives by both established retailers and venture-backed startups. Strategic partnerships between local platforms and international e-commerce giants will accelerate innovation transfer and competitive intensity. Regulatory developments supporting digital commerce, data protection, and consumer rights will create stable operating environments that encourage long-term investments.

Emerging technologies including artificial intelligence, machine learning, robotics, and autonomous delivery vehicles will progressively transform operational models, enabling platforms to improve prediction accuracy, optimize inventory management, reduce delivery costs, and enhance personalization. These technological advances will be essential for maintaining profitability as market maturity increases competitive pressures on pricing and service levels.

Conclusion:

Saudi Arabia's online grocery market is driving retail transformation through digital innovation, government initiatives, and shifting consumer preferences. Key trends like quick-commerce, mobile-first strategies, omni-channel integration, and cold chain investments highlight its growth potential. By 2033, the market will experience innovation, heightened competition, and evolving service standards, expanding accessibility across regions. Success will rely on operational excellence, technology, and understanding local market dynamics. Businesses must grasp competitive trends, regulatory frameworks, consumer behavior, and technological shifts to make informed strategic decisions and capitalize on this evolving opportunity.

Choose IMARC Group for Unmatched Expertise and Core Services:

- Market Insights: Detailed analysis of Saudi Arabia’s online grocery market, covering digital adoption, consumer behavior, platform performance, and competitive landscape.

- Growth Forecasting: Projections for opportunities in quick-commerce, omni-channel retail, fresh food growth, and technological innovations in grocery e-commerce.

- Competitive Benchmarking: Evaluation of leading platforms, digital transformation of traditional retailers, logistics providers, and payment tech integrations driving market share.

- Policy & Infrastructure: Updates on regulatory developments, data protection, consumer protection, and investments in logistics, cold chain, and digital payment infrastructure.

- Custom Reports & Consulting: Tailored intelligence for market entry, delivery network expansion, product assortment optimization, technology platform development, and investment evaluation.

Partnership with IMARC Group: Empowering retail leaders, investors, and tech innovators to make informed decisions and drive growth in Saudi Arabia’s online grocery market.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)